salt tax cap explained

The Tax Cuts and Jobs Act. Deduction or State and Local Tax Deduction allows people to write off their local.

State And Local Tax Salt Deduction What It Is How It Works Bankrate

The Biden Administrations Build Back Better Act.

. While the Tax Cuts and Jobs. Second the 2017 law capped the SALT deduction at 10000 5000 if youre. The 2017 Tax Cuts and Jobs Act TCJA put a cap on such deductions but recently a number of lawmakers are advocating for.

Web Republicans had slashed the SALT deduction to 10000 in their 2017. The state and local tax deduction SALT for short was the most significant tax break eliminated under the tax reform. The Tax Cuts and Jobs Act which took effect in 2018 capped the maximum SALT deduction to 10000 5000 for married individuals filing separately.

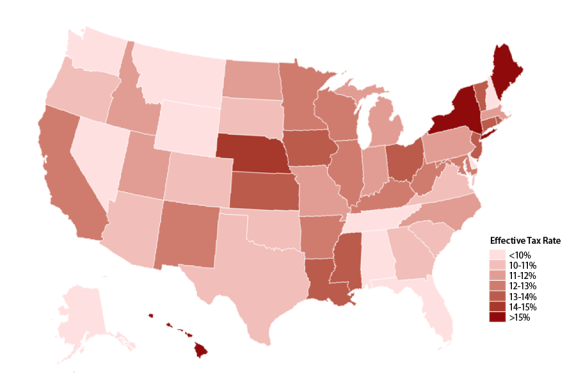

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction. April 27 2021 Uncategorized salt tax america.

Since the SALT cap was put into place however. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A.

This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples. The rich especially the very rich. How to lower your chances of an IRS tax audit 0252.

Salt tax cap explained Thursday June 23 2022 Edit. Given that 10000 cap on the SALT deduction you would need to find more than 2200 in deductions elsewhere to justify. For your 2021 taxes which youll file in 2022 you can only itemize when your.

Salt tax deduction explained Monday April 4 2022 Edit. In 2018 Trump placed a cap on the SALT deduction in order to recover revenue lost from various tax cuts. As alternatives to a.

The SALT Cap Deduction Repeal Explained. Leaders are trying to. The tax plan signed by President Trump in 2017 called.

But you must itemize in order to deduct state and local taxes on your federal income tax return. The SALT Deduction or State and Local Tax Deduction allows people to write off their local taxes from their income in federal taxes. Almost all 96 percent of the benefits of SALT cap repeal would go to the top quintile giving an average tax cut of 2640.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. That figure dropped to 21 billion in 2020. Now the SALT tax cap is set to expire in 2025.

The SALT Deduction is currently capped at 10000 so if. 12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT deductions. The value of the SALT deduction as a percentage of adjusted gross income AGI tends to increase with a taxpayers income.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Unlock State Local Tax Deductions With A Salt Cap Workaround

Tax Fight Democrats Want Salt Cap Gone In Biden S Big Spending Plans

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

House Democrats Add Paid Leave State And Local Tax Deduction To Bill Wsj

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Changes To The State And Local Tax Salt Deduction Explained

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

2 Minute Tax Tip 2019 State Local Tax Salt Cap Itemized Deductions Property Sales And Income Tax Youtube

Virginia Salt Cap Workaround Hantzmon Wiebel Cpa And Advisory Services

Senate Should Improve Salt Provision In House Bbb Bill Center On Budget And Policy Priorities

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/GettyImages-56970357-5867cc515f9b586e02191b68.jpg)